Getting your business structure right from the outset is crucial in the UK, as it impacts everything from hiring employees to scaling up as your business grows. This chapter explores the most common business structures in the UK—sole trader, partnership, and limited company—and discusses their advantages and disadvantages. We’ll also clarify common misconceptions about naming your business and the differences between a registered business name and a trade mark.

Get the foundations in place

Think of your business structure as the foundation of a house. Once it’s set and you begin building, it’s challenging to go back and change it. Establishing your business correctly from the start is simpler and less stressful. As your business grows, changing the structure could become complex and costly, potentially hindering opportunities for expansion.

You have three main structures to consider:

- Sole Trader

- Partnership

- Limited Company

A fourth structure, the ‘trust’, is less common and more complex, usually employed for tax reasons. If interested, consult an accountant or tax advisor.

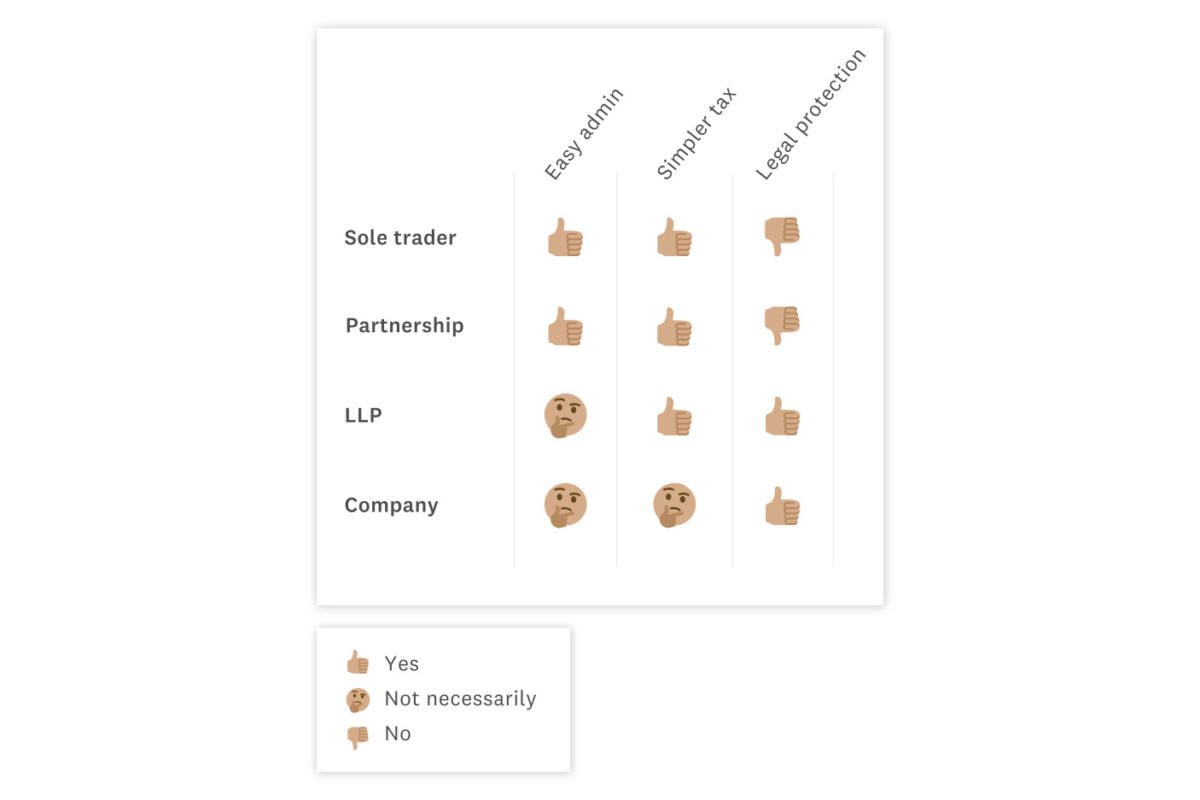

Business structures: compared

We’ve summarised some of the key differences between sole traders, partnerships and companies below.

Choose a structure

Your business structure should reflect your circumstances. Many start as sole traders due to its simplicity and low cost, which suits those without significant resources or capital. However, as the business expands, transitioning to a limited company might be considered. A limited company, typically indicated by “Ltd” (Limited) after the business name, is a popular option for small businesses and startups. To register, you must follow processes set by Companies House, including filing specific forms and paying a registration fee.

Navigating business structure decisions can be daunting, especially for newcomers to the business world. The UK government offers extensive online resources to help. Nonetheless, consulting with a professional, such as a lawyer, can provide tailored advice and clarify the implications of each structure.

If you’re launching a company solo, you’ll likely be the sole director and shareholder, making all decisions. This setup is common for small business owners and solo entrepreneurs.

Get tax advice

It’s vital to obtain tax advice tailored to your circumstances, as your business structure significantly affects your tax obligations. Consulting an accountant early on is advisable, and don’t hesitate to seek guidance on options like trusts if curious.

What’s a UTR and CRN?

You’ve probably seen references to UTRs and CRNs thrown around, and it can sometimes be confusing. Here’s a quick explanation of what they are:

- UTR (Unique Taxpayer Reference): A 10-digit number used by HMRC to manage tax.

- Company Registration Number (CRN): Issued by Companies House when a company is registered,

What to do about your business name

Choose a unique name for your business to avoid legal issues and confusion. A preliminary online search can help ensure the name isn’t already in use. The decision on your business name is significant, as it represents your brand to customers.

When legalising your business name, you should:

- Register the business name through Companies House if you’re forming a limited company.

- Consider registering a trade mark. While registering a business name grants you the right to use that name, it doesn’t prevent others from doing so. A trade mark offers broader protection against misuse of your brand. More about this in Chapter 6.

Shareholders and directors

If you are setting up a company, you should get to know the difference between directors and shareholders.

- Shareholders own the business and ultimately control the business.

- Directors are appointed by the shareholders to make decisions and oversee the operations of the business.

Often, as a founder of a new business, you are both a director and a shareholder. For detailed information about the responsibilities associated with various business roles, have a look at this page on the UK Gov website.

In conclusion…

In this chapter, we’ve learned about the importance of choosing the right business structure and some of the factors to consider when deciding which one is right for you. If you’re not sure whether you’re making the right choices, you’re welcome to contact us and ask about how we can help!

Interested in working with us?

Tell us about your legal issue and we’ll put together a fixed fee quote for you.

Previous

Previous